Case Studies

Strategic Solutions and Experts Services Building Client Success Stories

LP-led Deals: Proactive Pricing / Fund Monitoring

Request and Guidelines Provided

- The client requested assistance with tracking the quarterly valuation movement across a list of funds. These are typically the funds present across many LP-led deal and thus are of interest to the client

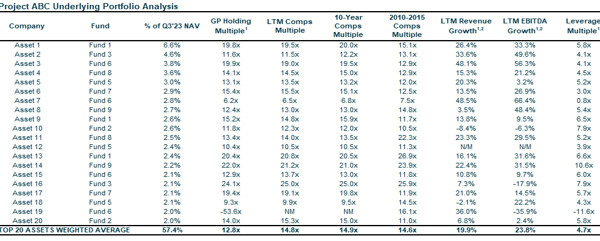

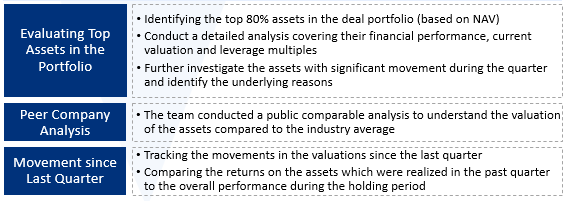

- The client required outputs which included preparing a detailed valuation of the top assets across the deal analyzing financial profile and public comparable exercise to understand the industry multiples

- Finally, the TresVista team writes Fund Assessment and Deal Team Commentary. The team also collates the outputs from the different models in on PPT for further discussions as the client’s end

Final Deliverable and Value-add

- The team has created a quarterly process which includes going through multiple fund reporting documents to source required data points and help the client track movements across the tops assets. The VP conducts internal discussions and presentations to help provide the client with additional commentary covering external factors

- The output included a summary of the valuation analysis (current multiple, closing multiple, and peer average) and financial performance during the last quarter

- The TresVista team also holds quarterly discussions with the client’s coverage team to present their underwriting and incorporate coverage team’s suggestions

Methodology

Snapshots of the Output

Recent Posts

ARM Worldwide

ETL Architecture

ARM Worldwide

Fundraising Dashboard

ARM Worldwide