Case Studies

Strategic Solutions and Experts Services Building Client Success Stories

LP-led Deals: ESG Analysis

Request and Guidelines Provided

- ESG considerations are increasingly crucial in today’s private equity landscape, driving sustainable value creation, mitigating risks, and meeting evolving investor and regulatory expectations

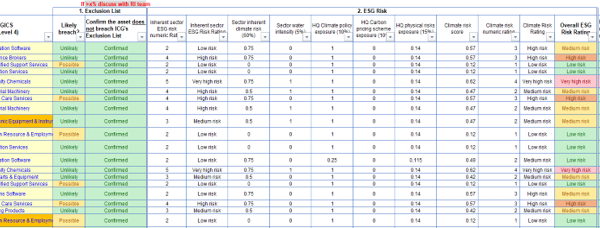

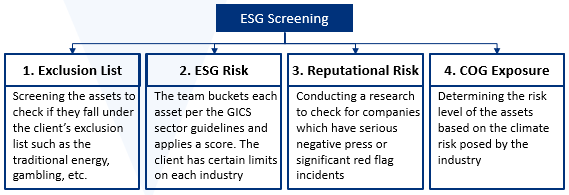

- The client required assistance conducting an ESG screening for all the underlying assets in the deal

- The screening required classifying the assets as per the GICS sector guidelines and understanding the concentration of the assets across various industries

Final Deliverable and Value-add

- Outputs included the detailed ESG screening analysis with classifications done based on the 4 levels and a summary of the entire deal portfolio

- The team leveraged the GICS classification and assisted the client in bucketing the portfolio of assets based on their operations. They also provided a summary of the findings which enabled easier decision making on the deal

- As the ESG-compliant framework equip funds with a competitive advantage to attract investors and lenders, the analysis performed by TresVista helped the client understand their ESG impact through the deal

Methodology

Snapshots of the Output

Recent Posts

ARM Worldwide

ETL Architecture

ARM Worldwide

Fundraising Dashboard

ARM Worldwide