Case Studies

Strategic Solutions and Experts Services Building Client Success Stories

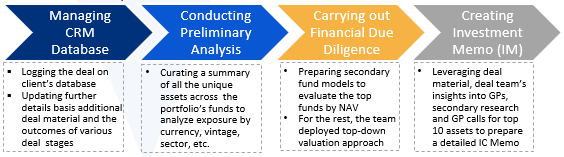

LP-led Deals: Deal Diligence Value-chain

Request and Guidelines Provided

- At the outset, the client sent over the deal details to be logged on their database

- Thereafter, they sent over the dataroom for the sale portfolio to commence the portfolio summary exercise in order to get a quick understanding of the top contributors (both by assets and funds) as well as their aggregate exposure

- Once the deal entered the LOI stage, the team conducted a bottom-up financial due diligence on the top assets of the major funds. To gather deeper insight into these funds, the team was also invited to various GP / Expert calls

- Conclusively, the team topped it off with a comprehensive Investment Committee (IC) Memo consisting company profiles, key fund-level statistics, and GP insights

Final Deliverable and Value-add

- The team gained understanding of screening and selection of the high-impact funds / assets in the sale portfolio in order to evaluate the deal prospect

- Replication of industry cognizance for one asset in an industry and quantifying its impact on another one in an adjacent industry

- Leveraging the AI Model and GP track record to value the funds / assets in the bottom 20% NAV list to form a holistic picture of returns

- Aligning diverse perspectives and proprietary know-how of the various deal team members and incorporating them throughout different deal stages

Methodology

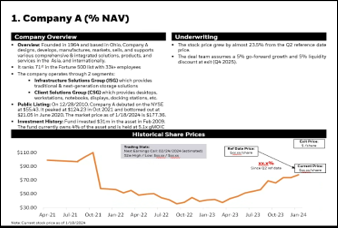

Snapshots of the Output

Recent Posts

ARM Worldwide

ETL Architecture

ARM Worldwide

Fundraising Dashboard

ARM Worldwide